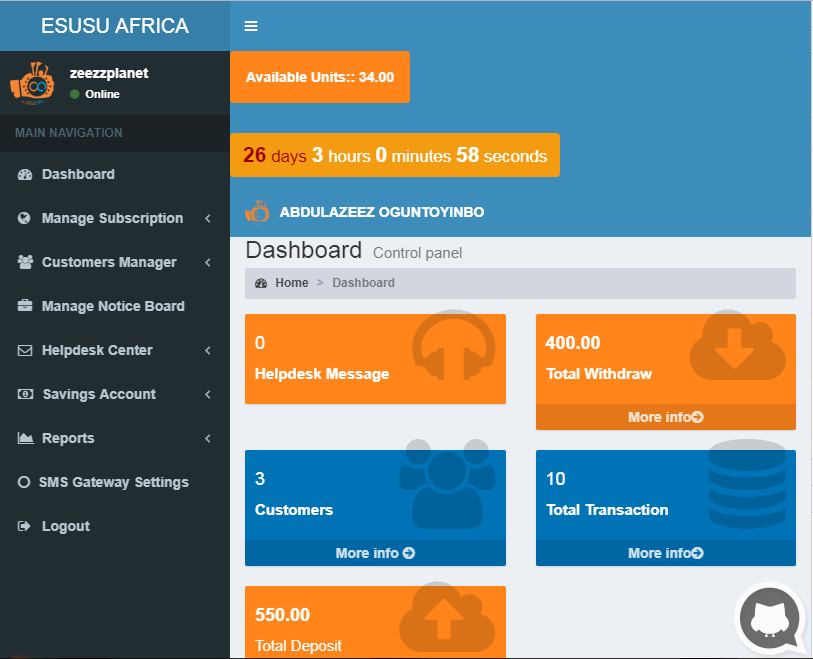

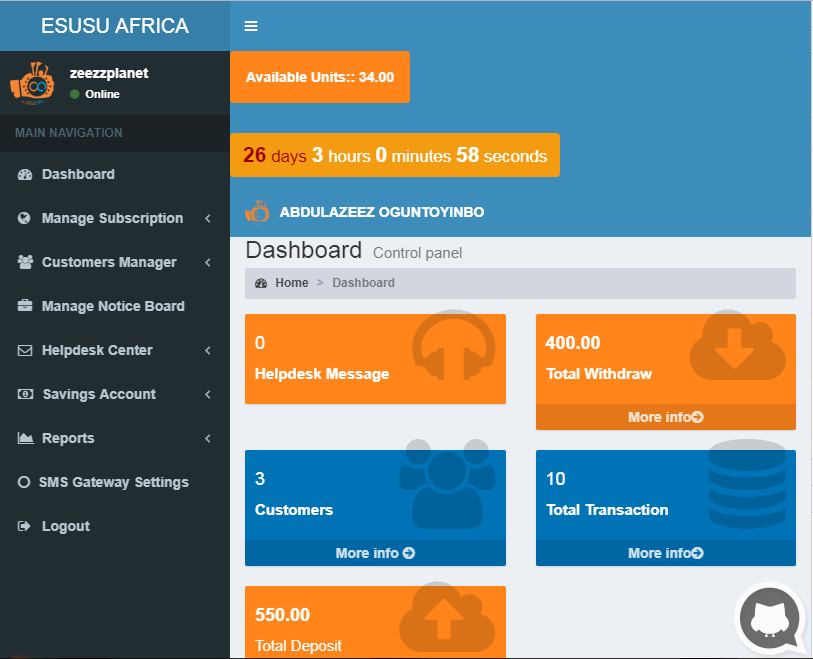

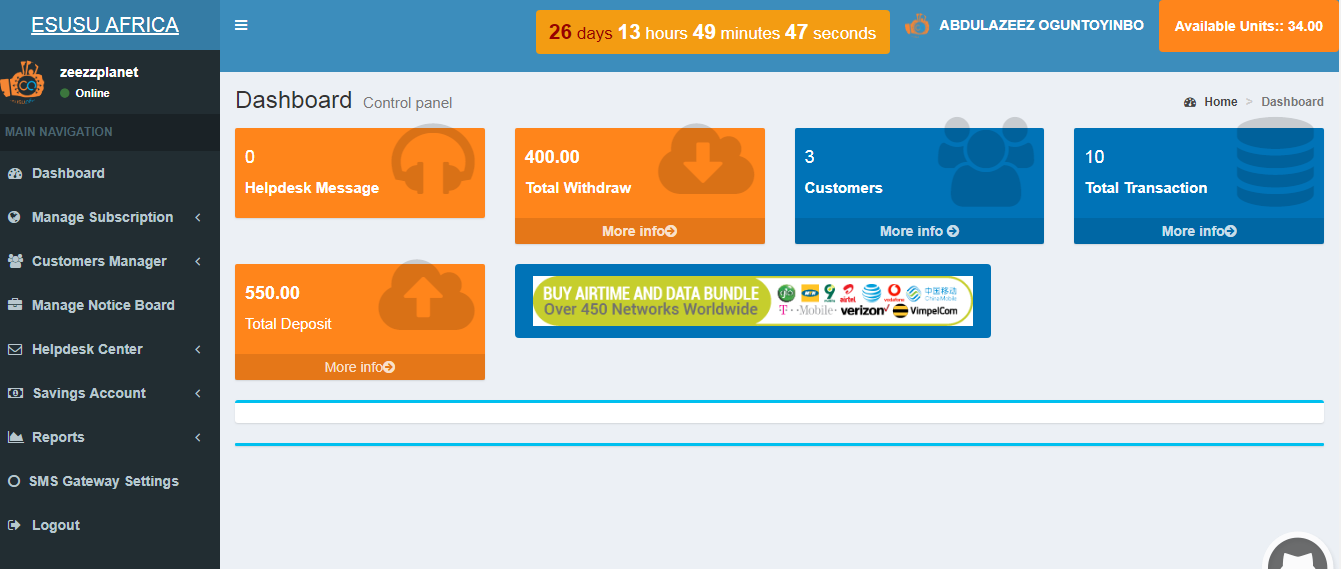

A multi channel finance management platform

Effective Customer, Agent and Group management.

The Esusu Management System works with both Individual and Group user methodologies. If a Group user graduates to become an Individual user, it is easy to change the user’s status. All individual and group user information is easily accessible, searchable and editable, while the workflows for adding new users and groups are based upon microfinance best practices. The system enables the capture of personal information, unique identifiers, next of kin details, business information and much more. You can upload scanned photos or documents to a client’s account.

Loans and Savings Management

The Esusu System offers full and flexible loan and savings modules. You have the freedom to extensively customize loan products, tweaking features such as the loan term, repayment frequency, interest rate, interest calculation method, grace periods, charges and more. All products are fully integrated with accounting, but you can easily set up specific accounting rules for different products if required. The processes around disbursing loans or activating savings follow best practice microfinance processes, requiring maker- checker principals at all times, while remaining intuitive and easy to use. You can capture collateral items linked to a loan, and add loan guarantors.

Cooperative management

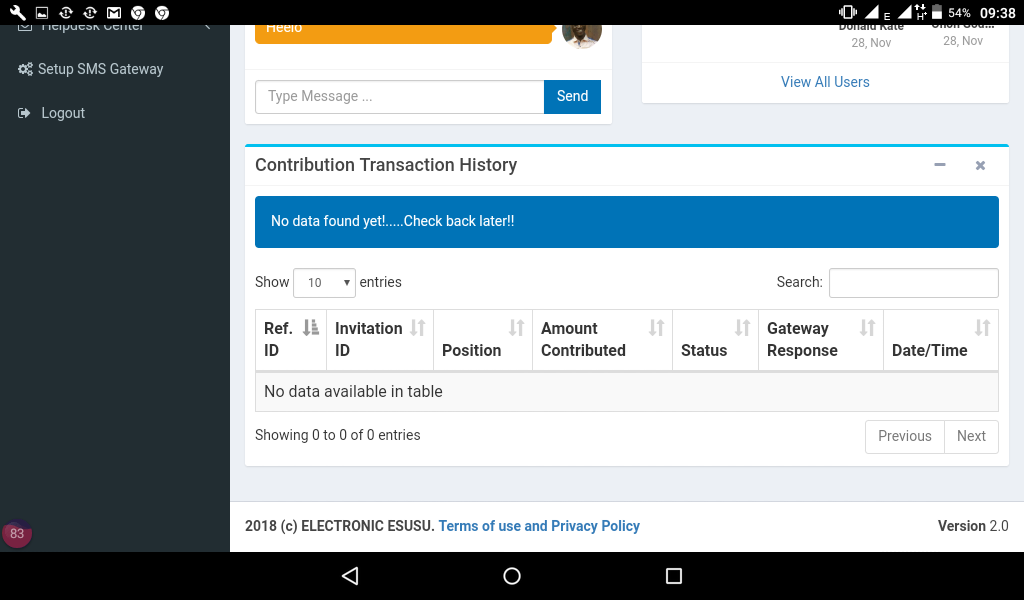

INTERNAL MESSAGING SYSTEM

The module is configured with a direct chat feature to allow for open and transparent tracking and discussions

INVITE AND CONNECT WITH COOPERATORS

Automating the group contribution process for debit card and bank account holders.

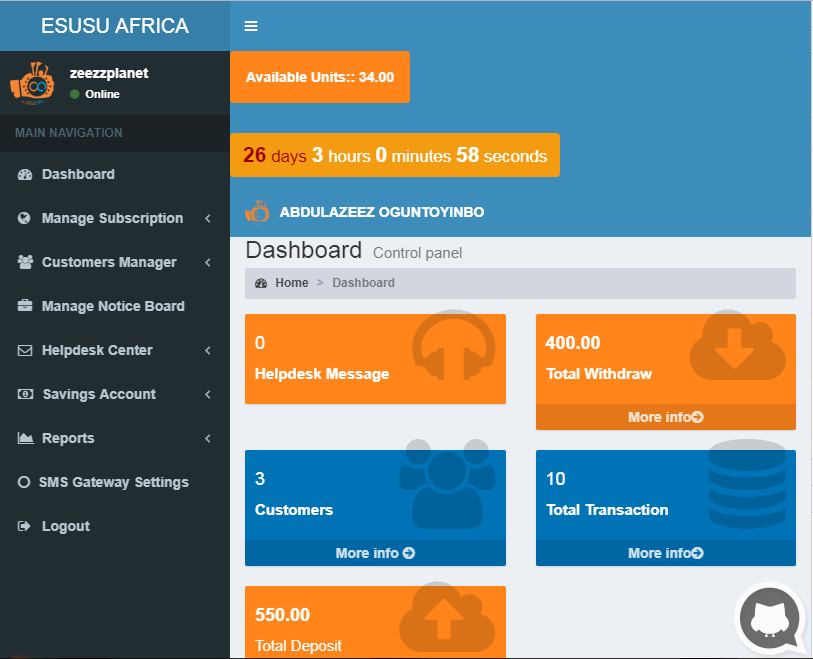

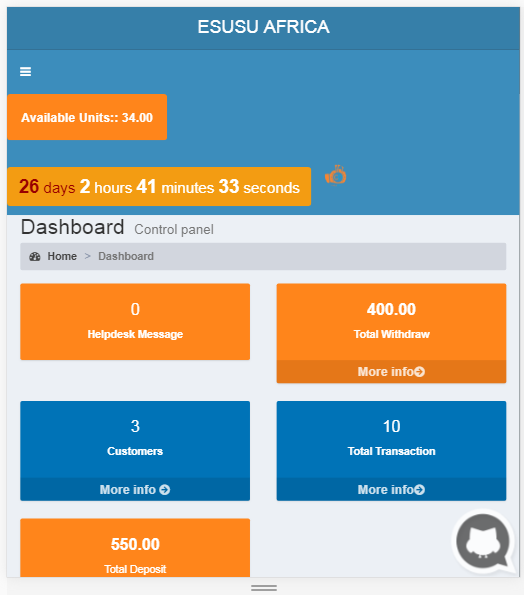

TRACK ALL TRANSACTIONS FROM THE APP.

Generate and Export real-time transaction reports to Excel,CSV, PDF.

High Quality Reports

The Esusu Management System provides an extensive suite of high quality reports, providing information on the portfolio, client numbers, savings accounts and portfolio quality at an institution level, branch level, loan officer level, right down to information on specific groups and users. All reports have been built using our experiences working in the field with industry experts, providing key information right to the fingertips of the individuals who need it most.

Customization and White-Label

Customize your profile such as logo, background color and theme. You can also have a custom notifications ID whether you’re on your computer or mobile device.

With fully Mobile responsive app for all devices, whatever you do on one device is reflected everywhere. Everything is in sync.

Open API Compliant

Constant switching between apps via open API. Set up your integration so that you get to sell and buy shared Value Added Services such as Bulk SMS, Airtime, Bills Payment, Funds Transfer directly within E-Esusu—from support requests, code check-ins, and APIs to sales leads—all of them configured in one central platform.

Get Started Now!